Economic and Housing Research

Original research and analysis on housing trends, the economy and the mortgage market

-

Research Note | May 7, 2021

Housing Supply: A Growing Deficit

In a recent "Perspectives" piece about the housing supply shortage, Freddie Mac's Chief Economist, Sam Khater highlighted the growing deficit that the industry has been facing, not only during the pandemic but even before the pandemic hit. More

-

Forecast | April 14, 2021

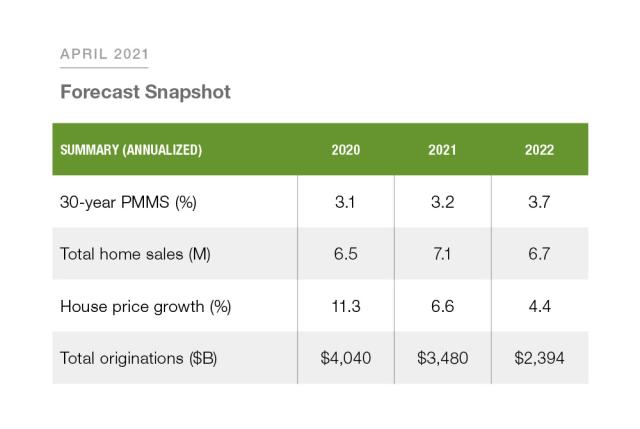

Quarterly Forecast: As the Economy Recovers, the Housing Market Remains Healthy While Mortgage Rates Move Up

Availability of the vaccine continues to improve, and COVID-19 restrictions are easing therefore sparking economic growth. With the passage of the American Rescue Plan Act of 2021, which included payments of up to $1,400 for individuals, $2,800 for married couples plus $1,400 for each dependent, consumer confidence in March reached the highest level since the start of the pandemic. More

-

Consumer Research | March 22, 2021

Confidence in Housing Market High as Concerns about Finances Linger

New Freddie Mac research shows the uncertainty renters and homeowners have about their ability to pay their rent or mortgage during the pandemic. More

-

Research Note | March 5, 2021

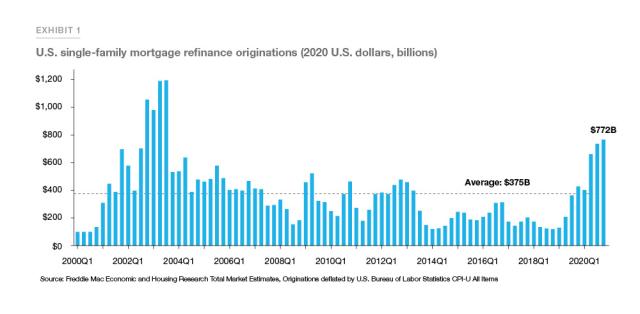

Refinance Trends in 2020

This past year was a busy year for the mortgage market. While the economy was in recession, record low mortgage interest rates contributed to refinance activity reaching near record highs. Many borrowers saved thousands of dollars by lowering their mortgage rate through refinances. This Research Note highlights some of the key trends defining refinance mortgage activity in 2020. More

-

Research Note | February 8, 2021

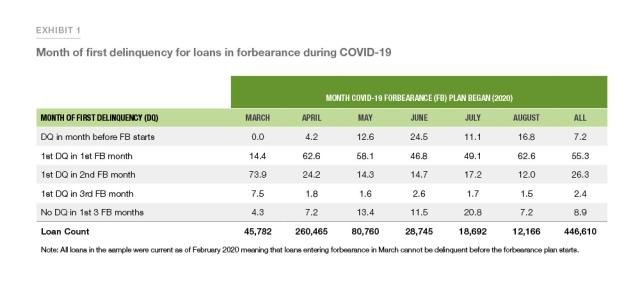

Mortgage Forbearance and Performance during the Early Months of the COVID-19 Pandemic

During the COVID-19 crisis, mortgage forbearance plans have played an important role in helping households manage their finances by providing short-term liquidity to mortgage borrowers. Mortgage forbearance plans temporarily remove the obligation of borrowers to make their monthly mortgage payment. More

-

Insight | January 28, 2021

U.S. Population Growth: Where is housing demand strongest?

What is the main driver of demand for housing in the United States? The answer is simple: people. The American population is a diverse group with multifaceted and individualistic housing needs. More