New Survey Shows Generation Z Ambitious Yet Realistic About Homeownership

The dream of homeownership is alive and well within “Generation Z,” the demographic cohort following Millennials, according to a pioneering new survey from Freddie Mac. Our survey of respondents (ages 14-23) finds that Gen Z views homeownership as an important goal. They estimate that they will attain this goal by the time they turn 30 years old, three years younger than the current median homebuying age (33). The poll collected data from 1,531 American teenagers and young adults.

Key findings from the survey:

Despite challenges, Gen Z strongly aspire to be homeowners.

Gen Z has strong, positive views of homeownership, and the overwhelming majority (86%) want to own a home someday. Gen Z does, however, see the following as obstacles to homeownership: home prices (92%), saving for a down payment (82%) and unstable job or job change (68%). For those who plan to pay for college, student debt is considered a major obstacle (54%).

The Gen Z median self-estimated age at the time of first home purchase is 30 years old, compared to the current median age of 33 for first-time homebuyers. In addition, the majority of Gen Z see homeownership as something to be proud of (93%), a sign of success (86%), something that provides privacy (93%), and providing independence and control (88%).

Gen Z is financially educated but lacks knowledge of the mortgage process.

Gen Z respondents report that they have received a financial education at home and are at least somewhat confident in their future well-being. Moreover, 33% expect to pursue a bachelor’s degree, and 30% expect to pursue a master’s degree or higher, a significant increase from Millennials, who are currently at 27% and 12%, respectively. In terms of financial awareness, 65% of Gen Z respondents report that they are not confident in their knowledge of the mortgage process. To learn more, 71% of Gen Z would consult with a parent, 58% with a real estate agent, 54% with the Internet, 45% with other family and/or friends, and 41% with a bank or mortgage lender.

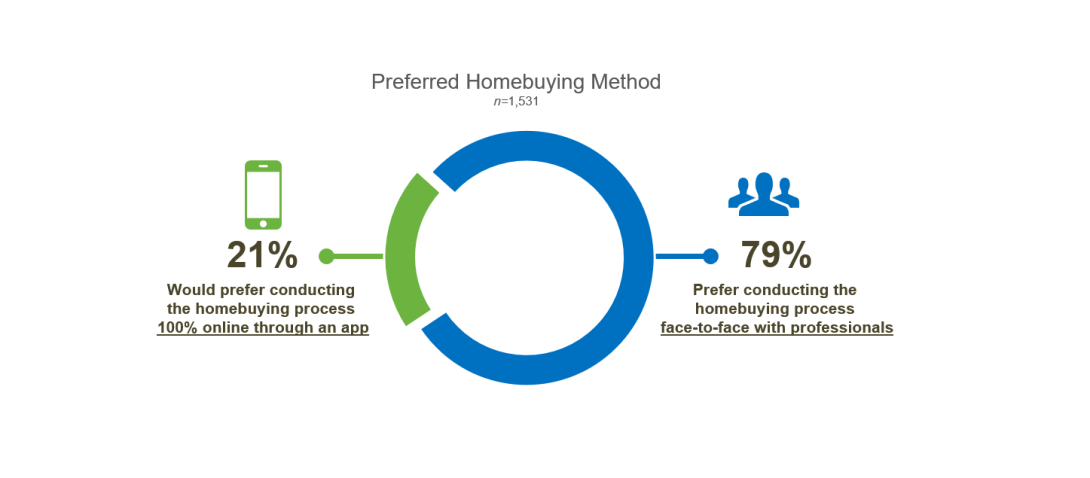

Perhaps surprisingly for this digital generation, when they are ready to purchase their first home, a significant majority of Gen Z (79%) would rather have face-to-face interactions with professionals than carry out the process fully online.

Gen Z sees importance of renting but consider renting less appealing.

Freddie Mac compared its latest research with past surveys, finding that fewer 18-23 year old members of Gen Z see renting as more appealing than buying a home versus Millennials at the same age (19% to 30%); fewer believe renting makes you feel like part of a community (33% to 39%); and fewer perceive that it costs less to rent a home than to own a home (40% to 51%).

However, Gen Z acknowledges the positive aspects of renting, such as having flexibility over where to live (68%), lower stress than owning a home (63%) and affordable proximity to a medium or large city and the ‘action’ associated with urban living (62%).

Of note, more than one-quarter of respondents think that owning a home at any point in their life seems out of reach financially. This is higher among those who report that money has been a stressful topic in their family (36%). It is also higher among those that currently live in a rented home (30%).

Survey Methodology

Freddie Mac contracted with IPSOS to conduct the online survey over a 12-day period, beginning July 12. The poll collected data from 1,531 American teenagers and young adults aged 14 to 23 years old. The data has been weighted to reflect the composition of the U.S. adult population. According to the U.S. Census Bureau, there are approximately 63 million people in the U.S. who make up Gen Z (of which 42.2 million are ages 14-23).