Economic, Housing and Mortgage Market Outlook – December 2024

In this Issue

- The U.S. economy remains robust with strong Q3 growth driven by consumer spending.

- Rebounding mortgage rates weighed on housing and mortgage activity reflected in lower new home sales and construction activity.

Recent developments

U.S. economy: The U.S. economy continues to grow at a strong pace, as evidenced by the second estimate of Q3 2024 Real Gross Domestic Product (GDP).1 Growth for Q3 was 2.8% at a seasonally adjusted annual rate, a slight decrease from the rate of 3.0% in the second quarter, but consistent with the advance estimate. The second estimate reflected increases in consumer spending, exports, federal government spending, and nonresidential fixed investment. As with the previous quarters, in Q3 2024, consumption spending led growth by contributing 2.4 percentage points to real GDP growth, compared to a contribution of 1.9 percentage points in Q2 2024.

The labor market rebounded from the lows of October as the impact of the hurricanes receded and the Boeing strike resolved. November saw payroll gains of 227,000 with October gains revised up from 12,000 to 36,000. Combined, September and October were revised up by 56,000. Employment growth is still consistent with a job market that is cooling from the highs seen over the last couple of years. The unemployment rate remains low at 4.2% in November 2024.

U.S. inflation, which had been receding over the past few months, ticked up slightly in October. Core inflation as measured by the Price Index for Personal Consumption Expenditures (PCE) less food and energy rose 0.3% over the month in October and 2.8% from a year ago. Prices for goods decreased 0.1% over the month but were offset by a 0.4% increase in prices for services. Although showing a modest increase in the year over year rate, core PCE price inflation is still consistent with expectations of a gradual cooling of inflation as the long and variable lags of monetary policy work their way through the economy.

Economic growth for 2024 has remained strong and is on track to be above the long run trend growth estimate. The labor market, while cooling, continues to remain strong and inflation continues to slowly move towards the Fed target of 2% indicating that we remain on a path towards a soft landing.

U.S. housing and mortgage market: Home sales remained subdued amid rising interest rates throughout October. Total (new + existing) home sales remained virtually unchanged in October. After reaching their lowest level since 2010 in September, existing home sales increased 3.4% over the month in October to 3.96 million. This increase in existing home sales was offset by new home sales, which fell sharply in October to an annual rate of 610,000, the lowest level since November 2022. Both hurricanes Helene and Milton had negative effects on home sales, with much of the decline occurring in the south. After ticking up slightly last month, the supply of existing homes decreased to 4.2 months in October. Homeowners are still not incentivized to sell, keeping supply below the 5 to 6 months’ supply indicative of a balanced housing market.

Housing construction slowed in October. Total housing starts declined 3.1% from September and 4.0% from last October. This decrease was primarily due to a slowdown in multifamily construction, which decreased 12.6% from last October. Homebuilder confidence rose for the third consecutive month to an index of 46 in November, according to the National Association of Home Builders’ (NAHB) Housing Market Index. The increased confidence is mostly due to the Federal Reserve loosening monetary policy as builders benefit from interest rate cuts which help lower construction financing costs. Despite this increase, the index has remained below 50 since August 2023, indicating that building conditions are expected to remain weak in the near term. The NAHB Housing Market Index is a diffusion indexed constructed so that a value of 50 indicates sentiment is on balance neutral, while values above (below) 50 indicate that sentiment is on balance positive (negative).

House price appreciation continued to slow from the highs witnessed in 2022. As measured by the FHFA House Price Index, U.S. house prices in September 2024 rose 0.7% month-over-month and 4.4% from last year. All nine census divisions showed annual increases.

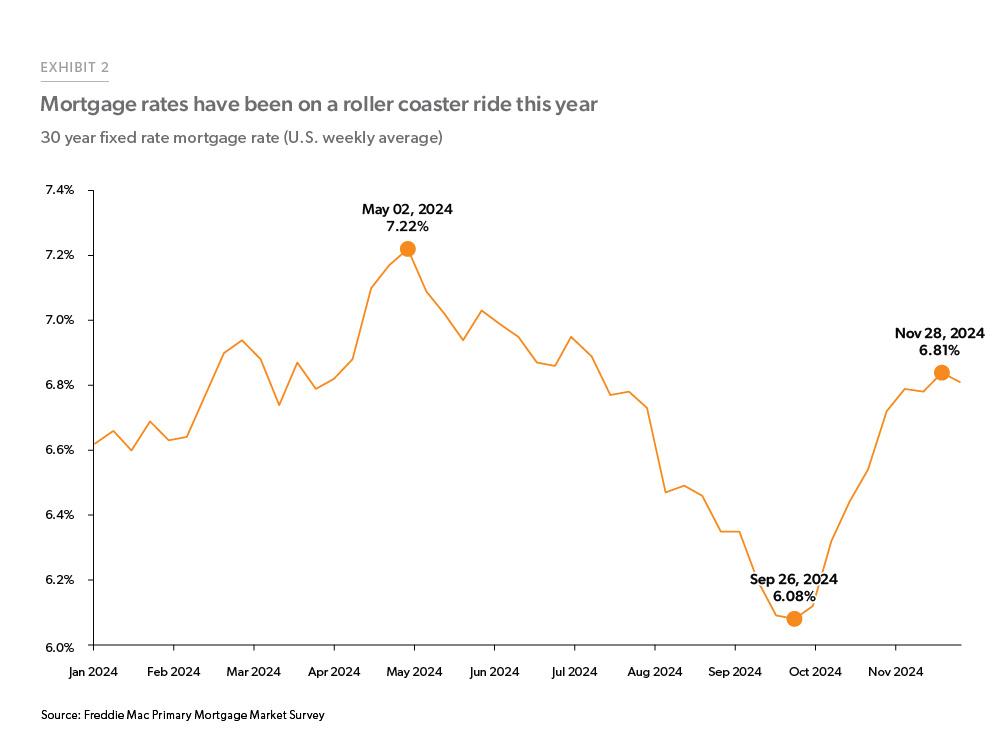

Mortgage rates remained elevated throughout November, ending the month at 6.81%. The 30-year fixed-rate mortgage as measured by Freddie Mac’s Primary Mortgage Market Survey® averaged 6.81% in November. Mortgage rates have remained essentially flat throughout the last few weeks, keeping potential homeowners waiting for affordability to improve. Refinance activity accounted for about 38% of total application activity at the end of November, decreasing since September as mortgage rates continued to rise. While refinance activity decreased, there was a slight uptick in purchase activity as potential homebuyers reacted to the modest decrease in rates. Purchase applications were up 23.5% in the last week of November as compared to the last week in October.

Outlook

Before we delve into the outlook for 2025, let’s look back at 2024 to see how the economy and housing markets evolved. Below are our top three trends of 2024.

1. Resilient U.S. labor market:

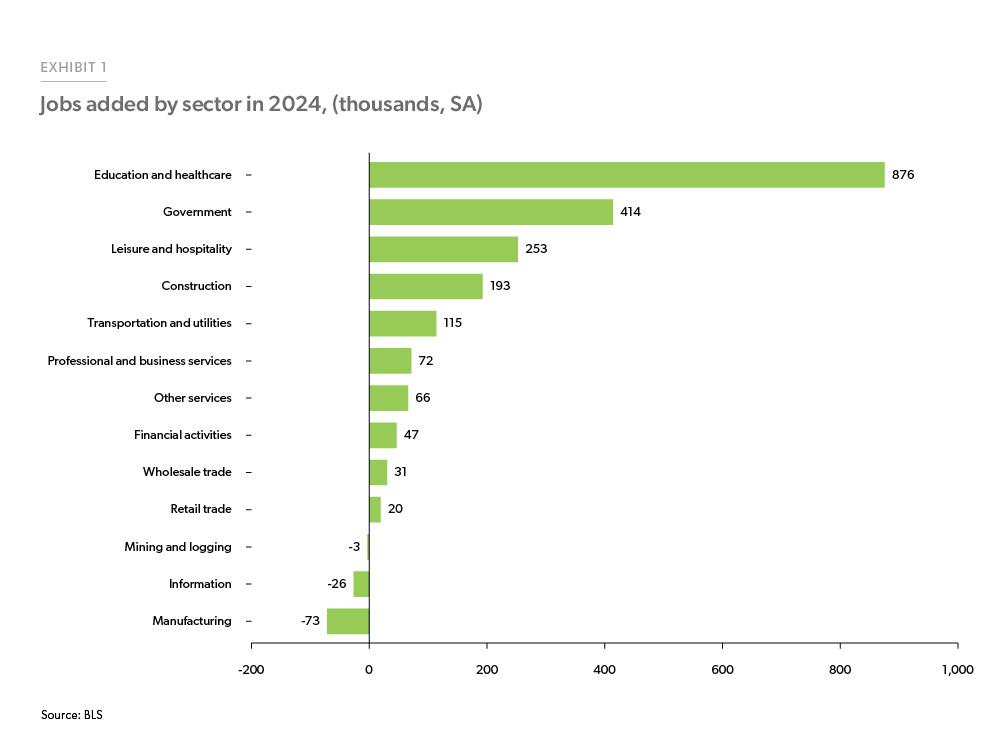

The 2024 U.S. labor market, despite the uncertainty, demonstrated remarkable resilience. Job openings and hiring rates stabilized compared to the post-pandemic recovery. As of November 2024, 1.98 million jobs were added to the economy, equating to 165,000 jobs per month. Education and healthcare sectors added the most jobs followed by government, professional and business services and leisure and hospitality (Exhibit 1).

The unemployment rate hovered near the pre-pandemic level and currently sits at 4.2% averaging around 4% for the eleven months of the year so far. Despite economic challenges, there was a gain in average hourly earnings of around 3.9% to 4.3% in 2024. Overall, the labor market exhibited resilience, even in the face of economic shifts and inflationary pressures.

2. Interest rate volatility:

Interest rates have been very volatile over the year mainly due to the uncertainty around the Federal Reserve rate path and the elections (Exhibit 2). At the beginning of the year, higher-than-expected inflation and stronger economic growth led to a reevaluation of the Fed’s rate path and the Federal Reserve decided to hold the fed fund rates at the 5.25-5.5% range. But since May, with some cooling in the inflationary pressures, the Federal Reserve signaled upcoming rate cuts, which materialized starting in September. Most of the declines in mortgage rates were already baked in by the first Fed rate cut in September. Since September, rates have been on the rise again, as we explained in our November Outlook, and ended the month of November at 6.81% after hitting 2-year lows of 6.08% in late September.

3. Rising homeowners’ insurance costs:

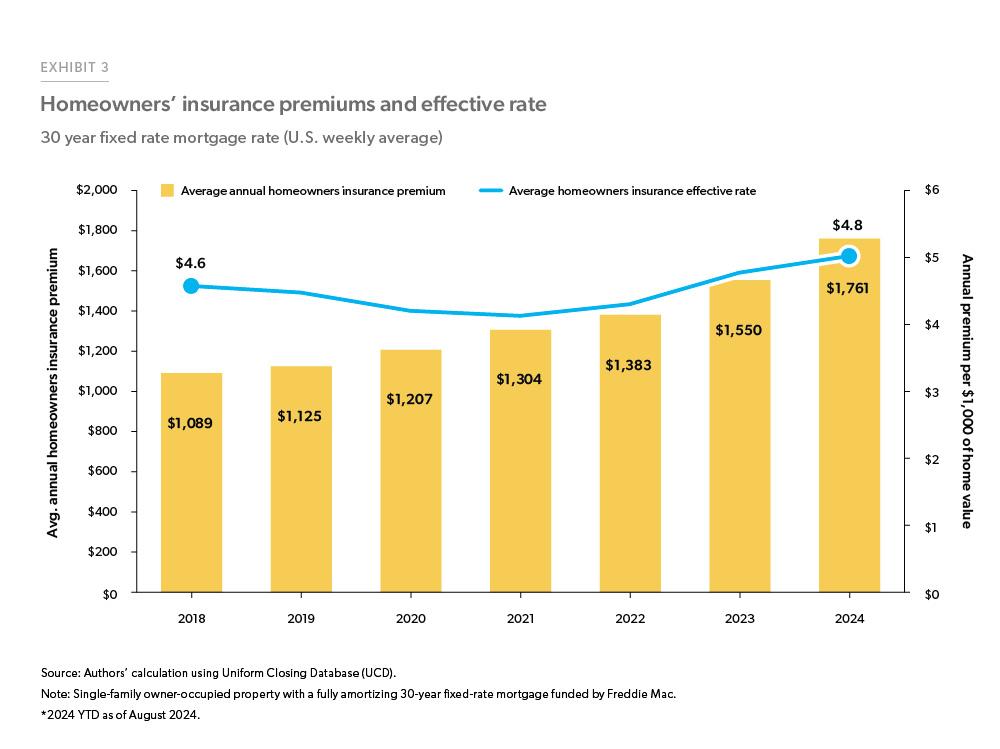

In 2024, housing affordability remained one of the most significant issues facing American households. High mortgage rates and home prices significantly contributed to declining affordability. Growing homeowners’ insurance costs further challenged housing affordability. According to our latest calculations, as of August 2024, an average borrower paid an annual homeowners’ insurance premium of $1,761, 13.6% higher than in 2023 and 61.8% higher than in 2018, with substantial variation across different states. As homeowners’ insurance costs continue to rise, borrowers face an increased financial burden. From 2018 to 2024 (as of August), the average borrower’s share of income spent on homeowners’ insurance premiums has increased from 1.5% to 1.7%. The burden of these costs is not evenly distributed. Some homeowners, especially those with lower incomes, are affected more by the increased cost of homeowners’ insurance than moderate- and high-income borrowers. Between 2018 and 2024, very low-income borrowers (those with an income no greater than 50% of the area median income) were consistently most burdened by such costs. As of August 2024, low-income borrowers spent 3.4% of their monthly income on homeowners’ insurance premiums. The impact of high interest rates and home prices affecting the principal and interest payments is much larger than the net impact of insurance cost, but it is still a significant burden on marginal borrowers trying to get into the housing market as well as homeowners with fixed incomes.

With this background, for 2025, we expect the economy to continue its growth, although at a slightly slower pace than in 2024. While there is still a considerable amount of policy uncertainty, under our baseline scenario, we expect inflation to continue to move towards the Federal Reserve’s target rate of 2% and a gradual cooling of the labor market from its recent levels. We also expect the Federal Reserve to continue on its implied rate cut path over the course of the next year.

We expect mortgage rates to decline over 2025, but very gradually. Declining rates will boost home sales to a slightly higher level than what we saw in 2024. Interest rate lock-in remains a major challenge for the housing market. Our estimate of the average interest rate lock-in effect for conventional mortgage borrowers was up from $42,000 in October to $47,800 in November 2024. House price growth may continue to moderate given increased supply and declining but still high mortgage rates. This modest growth in house prices, and the increase in home sales should support the purchase market in 2025. We also expect refinance volumes to increase mainly based on declining mortgage rates. We forecast total origination volumes to increase in 2025.

See the December 2024 spotlight on “homeowner and renter spending.”

Footnotes

- Bureau of Economic Analysis (BEA)

Prepared by the Economic & Housing Research group

Sam Khater, Chief Economist

Len Kiefer, Deputy Chief Economist

Ajita Atreya, Macro & Housing Economics Manager

Rama Yanamandra, Macro & Housing Economics Manager

Penka Trentcheva, Macro & Housing Economics Senior

Genaro Villa, Macro & Housing Economics Senior

Caroline Cheatham, Finance Analyst