Housing and Economic Research

Original research and analysis on housing trends, the economy and the mortgage market

-

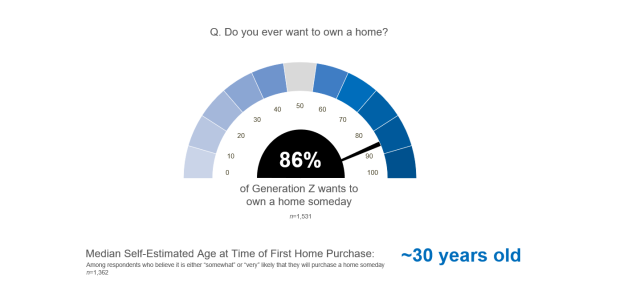

Consumer Research | November 21, 2019

New Survey Shows Generation Z Ambitious Yet Realistic About Homeownership

The dream of homeownership is alive and well within “Generation Z,” the demographic cohort following Millennials, according to a pioneering new survey from Freddie Mac. More

-

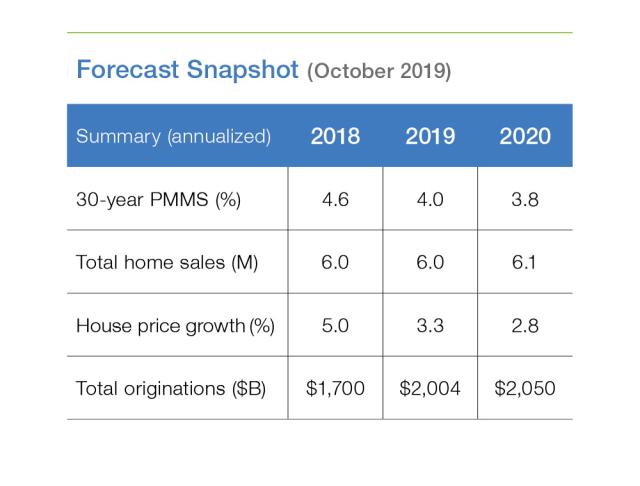

Forecast | October 31, 2019

Housing Market Remains Strong While Economic Slowdown Looms

September was the most volatile month for mortgage rates since the beginning of 2018 with an average week to week change of 11 basis points for the 30-year fixed rate mortgage. More

-

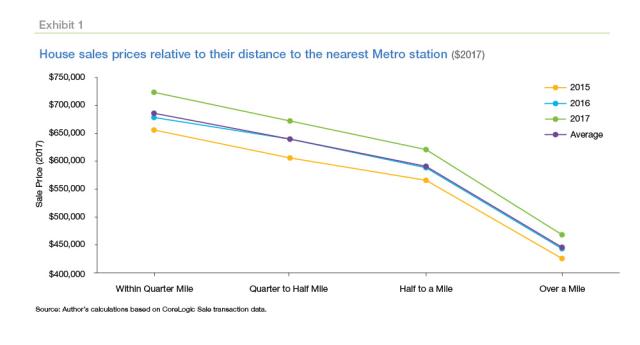

Insight | October 2, 2019

Proximity to a Metro Rail Station and Its Impact on Washington, DC Metropolitan House Prices: Amenity or Not?

Location, Location, Location are the three magic words when it comes to real estate. Everyone shops for the “right location” when buying a home, but determining the right location varies tremendously from buyer to buyer. More

-

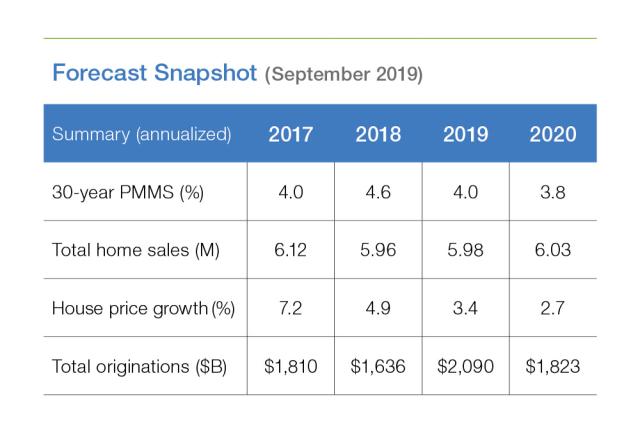

Forecast | September 30, 2019

Housing to Remain Strong Heading into the Fall

Though mortgage rates jumped in September, they remain down from where they were a year ago. The U.S. weekly average 30-year fixed-rate mortgage was 3.64% for the week ending September 26th, down 1.08 percentage points from a year earlier. More

-

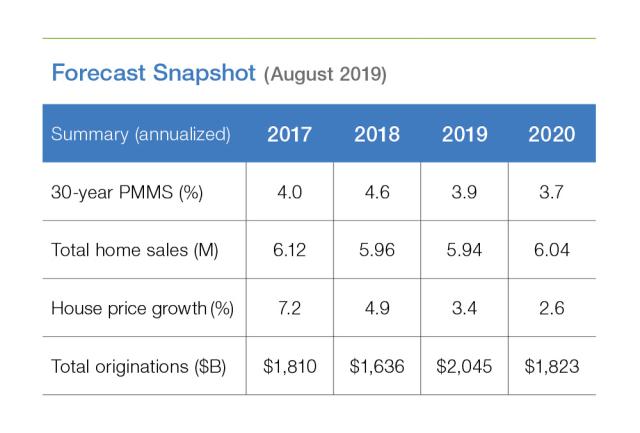

Forecast | August 28, 2019

Low Mortgage Rates, Strong Labor Market Fueling Housing Market

The recent decline in mortgage rates stem from the on-going global trade disputes and weakening global economy, which have led to a drop in long term interest rates in most countries. Despite the negative impacts of trade and the deteriorating global economy, the domestic U.S. economy continues to grow and the three-year low in mortgage rates has poised housing to reaccelerate. More

-

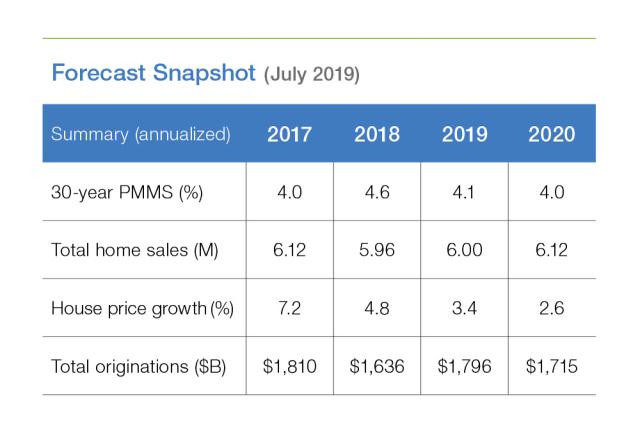

Forecast | July 30, 2019

Housing Market Sees Increased Momentum Due to Low Mortgage Rates

During the last week of May, the 30-year fixed-rate mortgage dipped below 4.0% and has remained there amid concerns over trade disputes, a possible economic slowdown, and market anticipation of a Federal Reserve interest rate cut. More