Housing and Economic Research

Original research and analysis on housing trends, the economy and the mortgage market

-

Research Brief | April 25, 2023

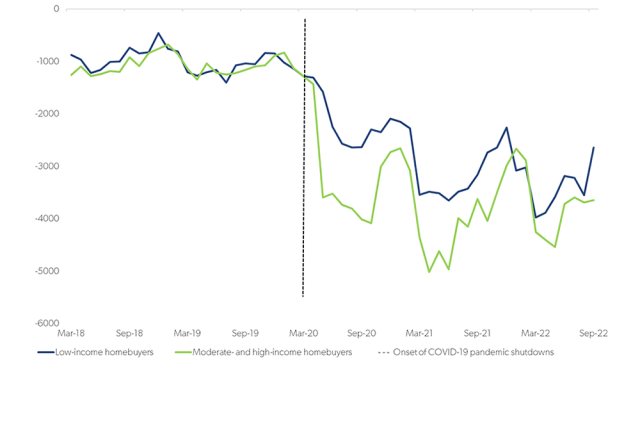

Low-Income Homebuyers Are Less Likely to Migrate from Cities, More Likely to Miss Potential Cost Savings

Since the start of the pandemic, low-income homebuyers are 25% less likely than moderate- and high-income homebuyers to move out of the top 25 largest metro areas, and those who don’t move may miss out on $1,800 per year in cost savings. More

-

Research Brief | March 23, 2023

Housing Sentiment in the First Quarter of 2023

In the first quarter of 2023, consumer confidence rebounds slightly while payment concerns and market activity remain largely unchanged. More

-

Research Brief | March 13, 2023

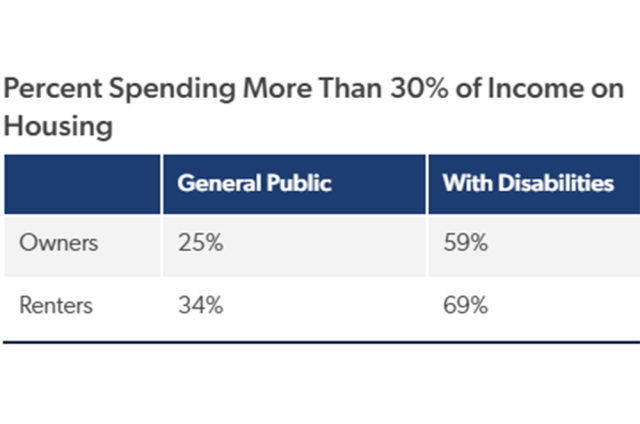

Renters and Homeowners with Disabilities Struggle with Financial Security and Housing Accessibility

A recent Freddie Mac study found that individuals with disabilities earn less and spend more of their income on housing, creating financial obstacles for those who want to buy a home. More

-

Research Brief | March 2, 2023

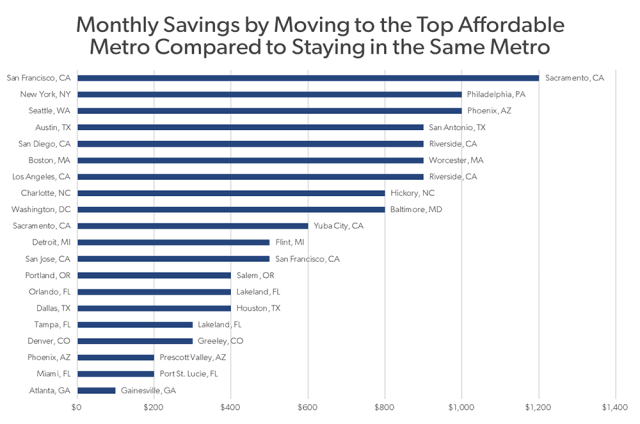

In Today’s Housing Market, Renters Have More Financial Incentive to Migrate to More Affordable Metros than Homeowners

First-time homebuyers’ incentives to move from a high-cost metro to a more affordable area are significantly higher in a higher interest rate environment, but existing homeowners have more incentive to stay put. More

-

Research Brief | February 16, 2023

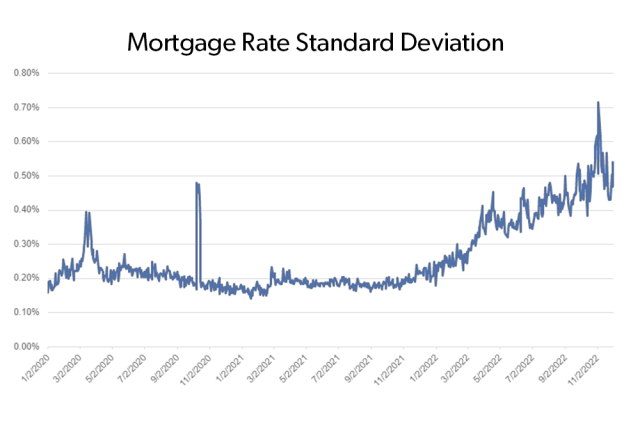

When Rates Are Higher, Borrowers Who Shop Around Save More

As mortgage rates remain higher than in recent years, homebuyers can potentially save $600-$1,200 annually by applying for mortgages from multiple lenders. More

-

Research Brief | January 24, 2023

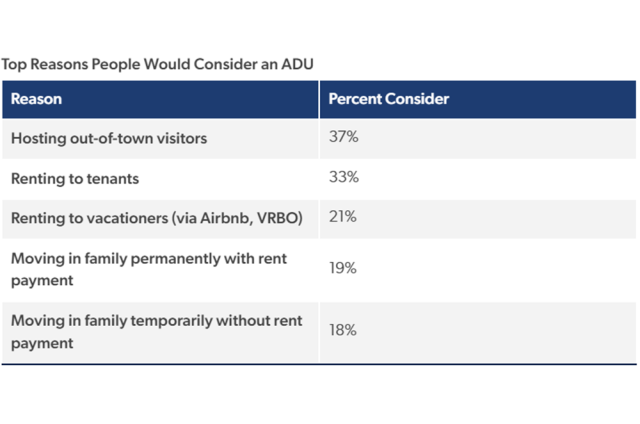

ADUs Can Increase Housing Stock, But Most Are Unfamiliar

A recent Freddie Mac survey attempted to gauge familiarity and interest in accessory dwelling units. The general lack of familiarity underscores the need for additional education and dedicated financing options. More