Tight Labor Market Prevails Despite Moderate GDP Growth

Economic growth decelerated in the first quarter of 2018, dropping to a 2.2 percent annual rate from 2.9 percent in the fourth quarter of 2017. Looking ahead, the combination of increased consumer spending and business investment is expected to push GDP growth slightly higher. We forecast real GDP to rise to 2.6 percent and 2.5 percent in 2018 and 2019, respectively.

Following a solid April, nonfarm payroll gains in May were even better. Strong job growth helped push the unemployment rate down to 3.8 percent—a new low in the current economic cycle. Average hourly earnings also inched up to 2.7 percent year-over-year in May. We forecast the labor market to maintain its current trajectory, with low unemployment, solid job gains and a gradual increase in wages. In our forecast, the unemployment rate averages 3.9 percent and 4.0 percent in 2018 and 2019, respectively.

Mortgage rates continue to rise

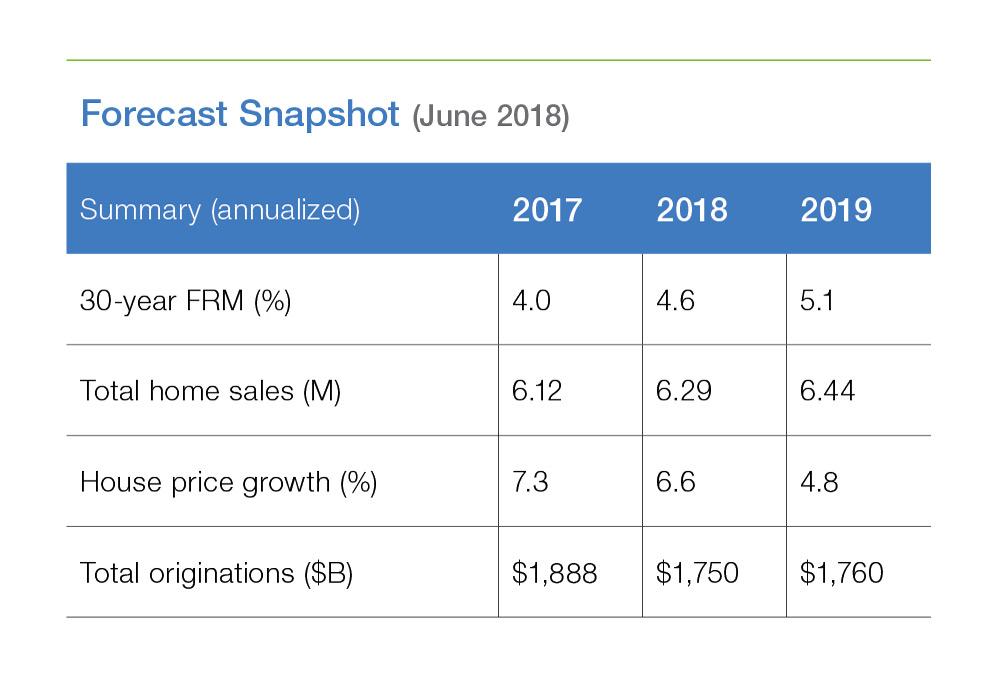

The 30-year fixed-rate mortgage reached a high of 4.66 percent in the third week of May and is sitting at 4.62 percent (as of June 14). The steady climb in mortgage rates have slowed recently because of declines in long-term Treasury yields, driven by tensions in Europe and uncertainty surrounding a possible trade war. The downward pressure on rates generated by uncertainty should help mitigate the forces pushing rates higher, such as rising inflation and continued monetary policy tightening. Our forecast has mortgage rates slowly rising, averaging 4.9 percent in the fourth quarter of this year, and increasing to 5.4 percent by the fourth quarter of 2019.

Housing demand remains healthy

The pace of home sales continues to hold up so far this year because of the strong underlying demand for buying a home. We forecast modest growth in total (new and existing) home sales over the next two years. Sales are expected to increase to 6.29 million this year and 6.44 million next year.

Increased homebuyer demand and limited supply continue to put upward pressure on home prices. However, with a gradual uptick in new supply, home price growth should begin to moderate. We forecast home prices to increase 6.6 percent in 2018, with the annual growth rate moderating to 4.8 percent next year.

Mortgage originations expected to decline this year

Higher mortgage rates are putting downward pressure on refinance activity, pushing total origination volume down so far in 2018. We forecast a 7 percent decline in total origination volume in 2018 to $1.75 trillion, before a small rebound (1 percent) in 2019 to $1.76 trillion. Home price appreciation and modest increases in home sales will drive purchase origination volume up, though not enough to offset the refinance decline expected this year. We forecast purchase origination volume to increase 4 percent to $1.25 trillion this year, and much more (8 percent) next year ($1.34 trillion).

PREPARED BY THE ECONOMIC & HOUSING RESEARCH GROUP