Housing and Economic Research

Original research and analysis on housing trends, the economy and the mortgage market

-

Research Brief | October 5, 2022

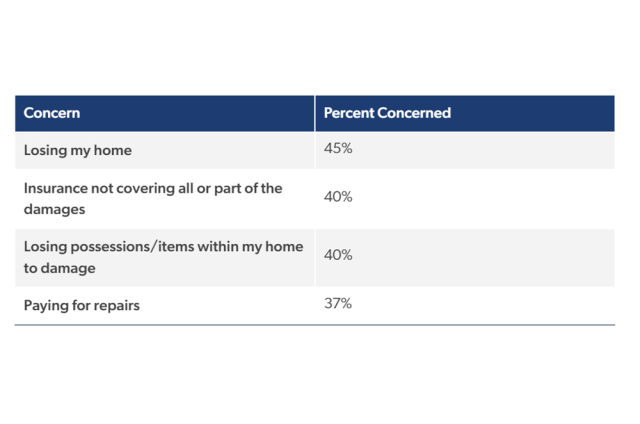

Homeowners Are Growing More Concerned about the Effects of Severe Weather

Severe weather-related events have outsized potential to affect a homeowner’s livelihood and the livability of their home. More

-

Research Brief | September 28, 2022

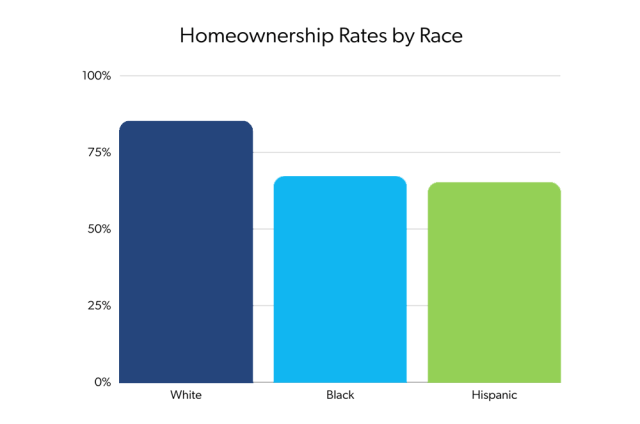

Among Aging Adults, Inequalities Affect Long-Term Financial Outlook

Many adults age 55 and older live in a healthy financial situation and are confident about the future. However, inequalities exist for renters and non-White adults. More

-

Research Brief | September 21, 2022

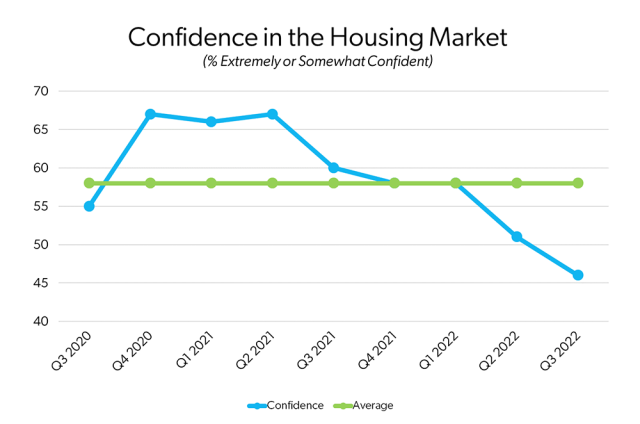

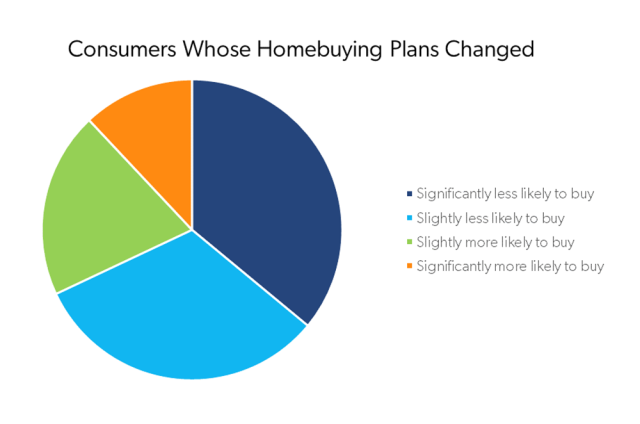

Housing Sentiment in the Third Quarter of 2022

In the third quarter of 2022, consumer’s confidence in the housing market and their likelihood to buy or refinance a home declined. More

-

Research Brief | September 8, 2022

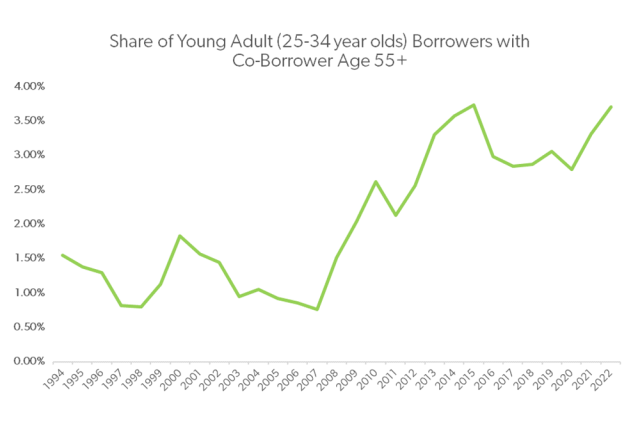

Co-Borrowing Is on the Rise for First-Time Homebuyers

An increasing percentage of young first-time homebuyers are relying on support from older generations, including their parents, to afford a home. More

-

Research Brief | August 22, 2022

How Higher Prices Have Changed Housing Costs, Consumer Spending Plans

In the past 12 months, rising inflation has impacted consumers’ household spending, rent prices and future financial plans. More

-

Research Brief | August 17, 2022

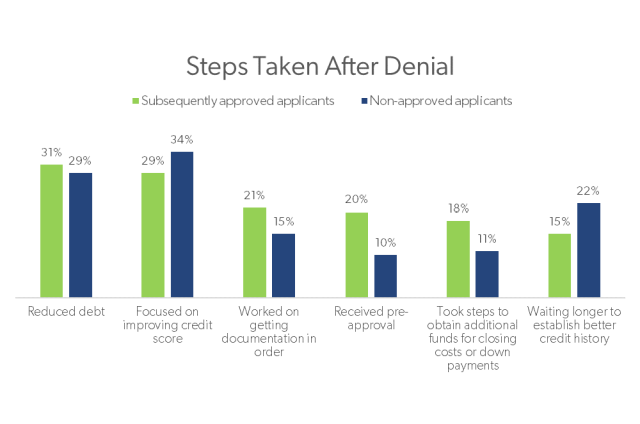

What Do Borrowers Do When a Mortgage Application Is Denied?

Although the housing finance industry may understand the basic denial causes, discovering how applicants respond after a denial can inspire potential solutions to increase the pool of approved applications going forward. More