Economic and Housing Research

Original research and analysis on housing trends, the economy and the mortgage market

-

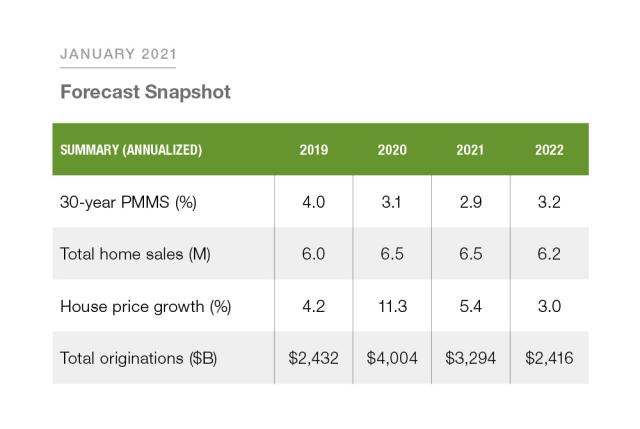

Forecast | January 14, 2021

Quarterly Forecast: Housing Market Continues to Perform Strongly Primarily Driven by Historically Low Mortgage Rates

It’s been close to a year since the pandemic began, and economic growth continues to remain uncertain. The availability of a COVID-19 vaccine and its widespread distribution should steer the economy towards recovery, but the timelines remain unknown. The labor market has recovered from the lows it reached in April of last year but continues to be weak. As of mid-December of 2020, jobless claims were still around 20 million, remaining well above the pre-pandemic levels. The unemployment rate was 6.7% in December with more permanent job losses and less labor force participation signaling a slowdown in the current labor market recovery. More

-

Insight | November 17, 2020

Mortgage Forbearance Rates during the COVID-19 Crisis

Bob and Jane purchased their home three years ago. Now, in the midst of the pandemic, Jane is furloughed from her job as a purchasing manager, and Bob is working fewer hours as a mechanic. They are wondering how long their savings will last. Postponing mortgage payments would make their reserves hold out a lot longer. More

-

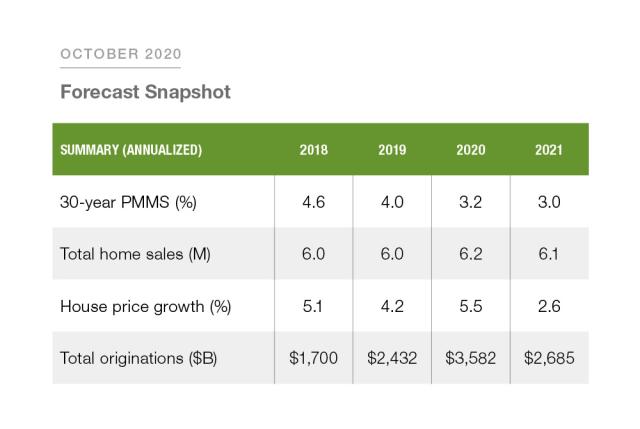

Forecast | October 14, 2020

Quarterly Forecast: Housing Market Continues to Rebound as Mortgage Rates Hover at Record Lows

Economic activity stalled in early July. Even with many businesses reopening, unemployment claims remained high through September. Total jobless claims were about 26 million in the second week of September. More

-

Research Note | September 10, 2020

Unravelling Perceptions of Flood Risk: Examining Changes in Home Prices in Harris County, Texas in the Aftermath of Hurricane Harvey

If you want to buy a home, is living near the water on your wish list? If so, how much do you worry about flooding? More

-

Insight | July 16, 2020

Granny Flats, Garage Apartments, In-Law Suites: Identifying Accessory Dwelling Units from Real Estate Listing Descriptions Using Text Mining

As the nation’s affordable housing crisis intensifies, there is a growing movement in high-cost areas for the legalization and expansion of accessory dwelling units (ADUs)—also referred to as granny flats, garage apartments, and in-law suites. More

-

Research Note | July 6, 2020

Refinance Trends in the First Quarter of 2020

American homeowners have many options when it comes to mortgage financing. Most homeowners with a mortgage opt for a fully pre-payable 30-year fixed rate mortgage. The fixed rate locks in a fixed payment for the life of the loan, while the 30-year term lowers the required monthly payment. More