Housing and Economic Research

Original research and analysis on housing trends, the economy and the mortgage market

-

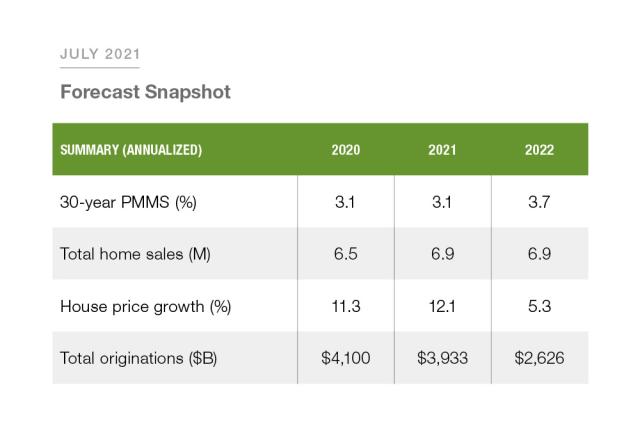

Forecast | July 15, 2021

Quarterly Forecast: Housing Market Expected to Remain Strong Despite Major Supply Shortage and Historically High House Prices Across the U.S. Slowing Sales

The latest employment report from the U.S. Labor Department showed that while the U.S. economy added 850,000 nonfarm payroll jobs in June, it is still down 6.8 million jobs from February 2020. Job openings have surged to a record high of 9.2 million, and as the economy continues to reopen, we expect the economy to continue to mend. Consensus forecasts put full year U.S. Real GDP growth over 6% in 2021, which would help to close the large gap between the current level of economic activity and potential output. More

-

Consumer Research | July 12, 2021

Credit Reporting Perceptions

According to a recent Freddie Mac survey of homeowners and renters, many Americans are confused about the impact of debt on their credit profile. More

-

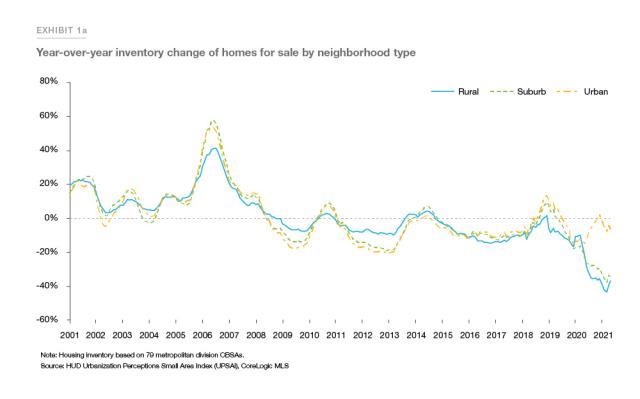

Research Note | July 12, 2021

Has An Urban Exodus Occurred? Residential Environment Trends Shaping the Future of Where We Live

As we noted in a previous report, there was an observed shift of home purchases in the last decade, even before the onset of COVID-19, from urban areas to suburbs and rural towns. We went on to link several possible socioeconomic factors driving the ongoing trend of household migration away from urban areas. More

-

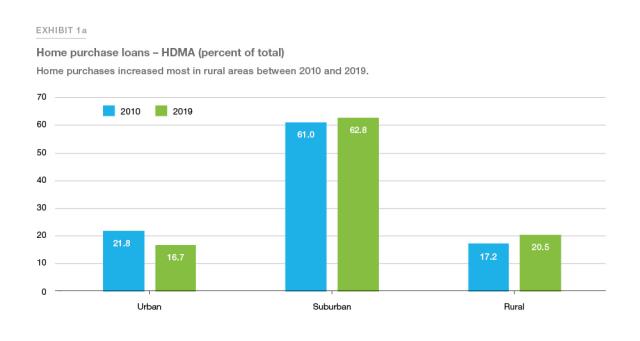

Research Note | June 2, 2021

Rural Home Purchases Outpaced Urban Purchases Through the 2010s

The COVID-19 pandemic has increased interest in homeowner mobility. There has been a growing trend of moving away from urban areas as housing preferences have shifted towards larger homes that are more conducive to remote work and virtual learning. More

-

Research Note | May 12, 2021

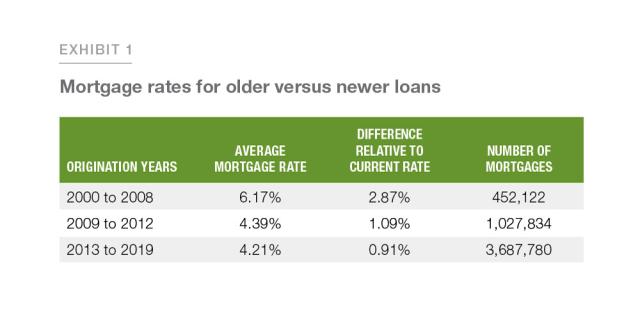

Almost 50% of Black and Hispanic Borrowers Could Save $1,200 Annually by Refinancing

The recent record low mortgage interest rates provide many borrowers with an opportunity to save thousands of dollars by lowering their mortgage rate through refinancing. But a closer look at who is refinancing demonstrates that many borrowers who could benefit from refinancing still aren’t pursuing the option. More

-

Research Note | May 7, 2021

Housing Supply: A Growing Deficit

In a recent "Perspectives" piece about the housing supply shortage, Freddie Mac's Chief Economist, Sam Khater highlighted the growing deficit that the industry has been facing, not only during the pandemic but even before the pandemic hit. More