Housing and Economic Research

Original research and analysis on housing trends, the economy and the mortgage market

-

Outlook | January 22, 2024

Economic, Housing and Mortgage Market Outlook – January 2024 | Spotlight: Discount Points

While the economy continues to expand and added 2.7 million jobs in 2023, signs point to a normalization in the labor market as job growth is expected to moderate in 2024. More

-

Outlook | December 20, 2023

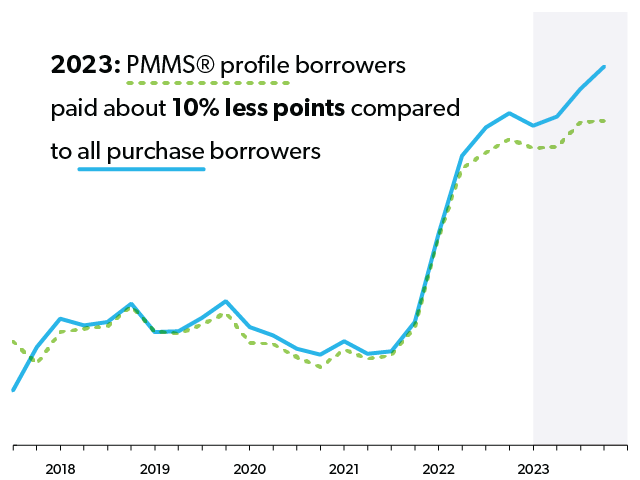

Economic, Housing and Mortgage Market Outlook – December 2023 | Spotlight: Top 3 Trends in 2023

Bolstered by resilient consumer spending and investment, the U.S. economy expanded in 2023, defying expectations of a recession. More

-

Outlook | November 21, 2023

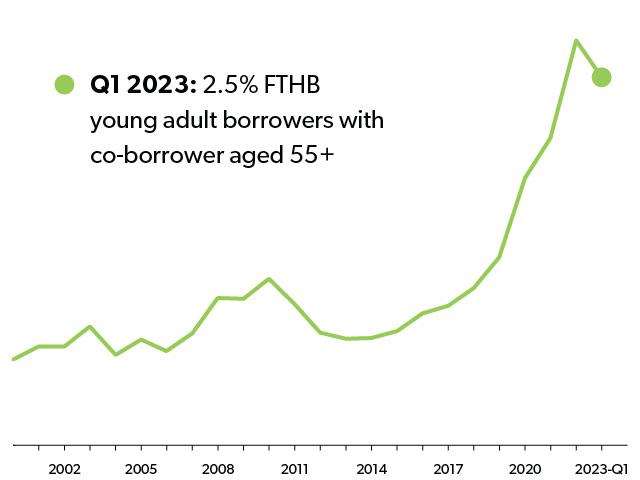

Economic, Housing and Mortgage Market Outlook – November 2023 | Spotlight: Young Adults and Co-Borrowing

Economic growth remained strong in Q3, primarily due to solid consumer spending. We expect the economy to slow down as the full impact of higher interest rates is felt. More

-

Outlook | October 20, 2023

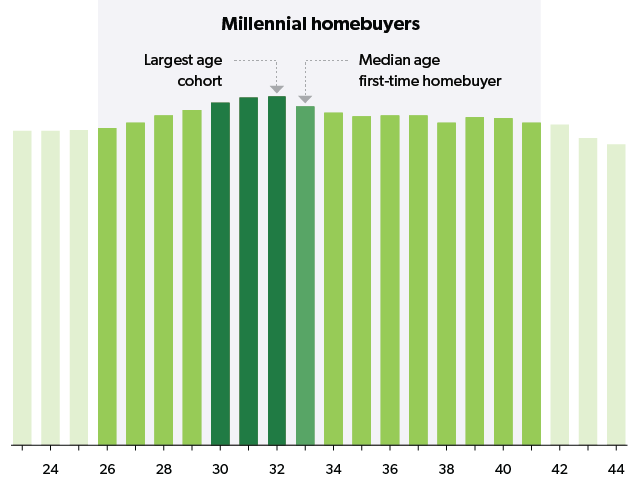

Economic, Housing and Mortgage Market Outlook – October 2023 | Spotlight: Millennial Household Formation

The U.S. economy continues to grow at a pace closer to long-term trend as the labor market and consumer spending remain strong. More

-

Outlook | September 21, 2023

Economic, Housing and Mortgage Market Outlook – September 2023 | Spotlight: Hispanic Homeownership Gap

While overall economic growth has been resilient, the labor market shows signs of cooling off, with job openings down and job growth softening. The labor market slowdown may help reduce inflationary pressures. More

-

Outlook | August 17, 2023

Economic, Housing and Mortgage Market Outlook – August 2023 | Spotlight: Refinance Trends

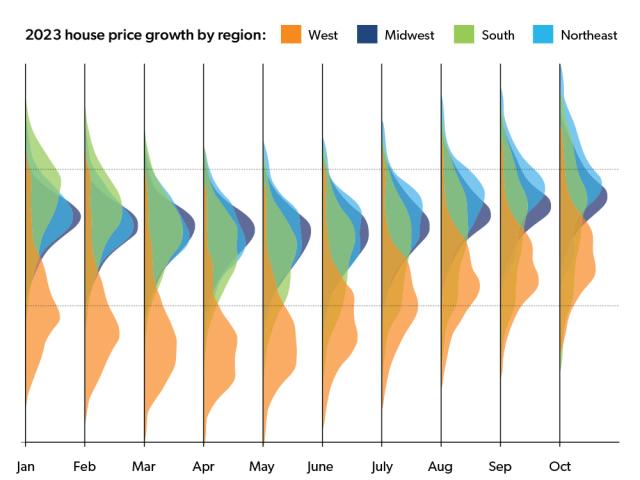

U.S. economic growth remains on firm ground, with strong consumption spending and a tight labor market. Although housing market activity has slowed, a demand-supply imbalance is causing a rebound in home prices. More