Housing and Economic Research

Original research and analysis on housing trends, the economy and the mortgage market

-

Research Brief | July 31, 2023

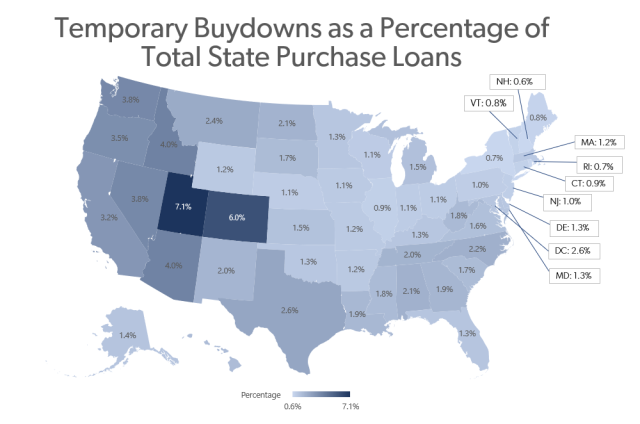

Temporary Mortgage Rate Buydown Activity Spiked in Late 2022, Now Becoming Less Common

In the second-half of 2022, temporary mortgage rate buydowns increased in popularity. However, several factors explain why temporary rate buydowns remain a niche market. More

-

Outlook | July 24, 2023

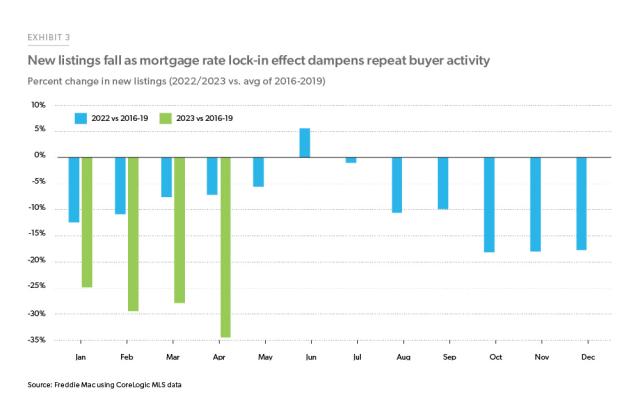

Economic, Housing and Mortgage Market Outlook – July 2023 | Spotlight: Rate Lock-In Effect

The U.S. economy grew at its long-run average rate of 2% during the first quarter of 2023 and the labor market remains strong with an unemployment rate below 4%. The housing market has been impacted by high rates with millions of U.S. homeowners locked into previously low mortgage rates and content to remain in their current homes, helping to keep inventory low. More

-

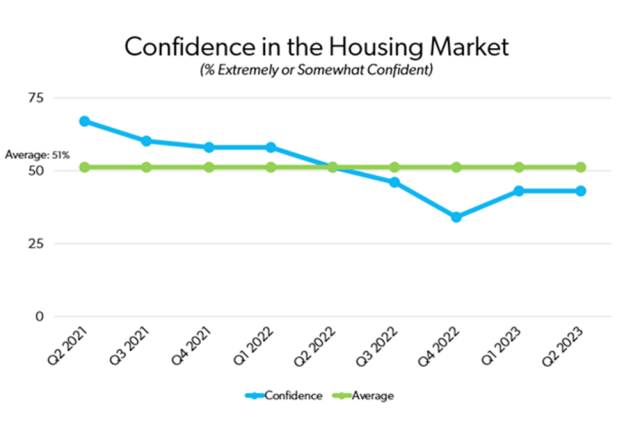

Consumer Research | June 21, 2023

Housing Sentiment in the Second Quarter of 2023

In the second quarter of 2023, consumer confidence remains unchanged while housing affordability and payment concerns continue to be top-of-mind. More

-

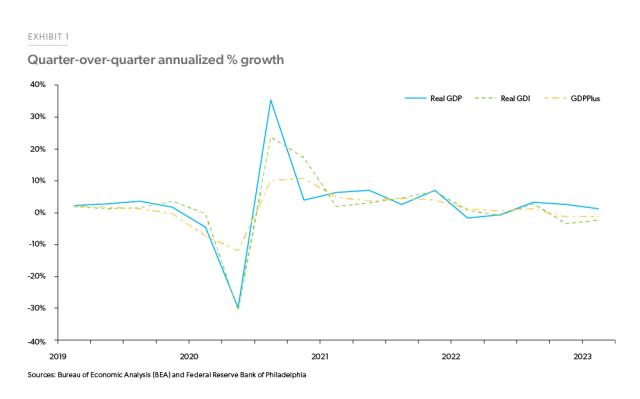

Outlook | June 16, 2023

Economic, Housing and Mortgage Market Outlook – June 2023 | Spotlight: Homeownership Rates

The U.S. economy is stalling as higher interest rates weigh on interest rate-sensitive sectors like housing. But the U.S. consumer has been resilient, and the broader economy has weathered several adverse shocks over the past year and a half, avoiding a recession so far. More

-

Research Brief | June 2, 2023

Millennials More Concerned Than Other Generations by Weather-Related Effects on Housing

More than half of all homeowners have grown more concerned about weather-related events. But according to a recent survey, the Millennial generation is far more likely to turn these concerns into action. More

-

Research Brief | May 24, 2023

The Top 10 Metro Areas Homebuyers Are Moving Into and Out of

According to recent Freddie Mac research, the pace of net migration is declining but the same metro areas are experiencing net migration gains and losses. More